- Book a Demo

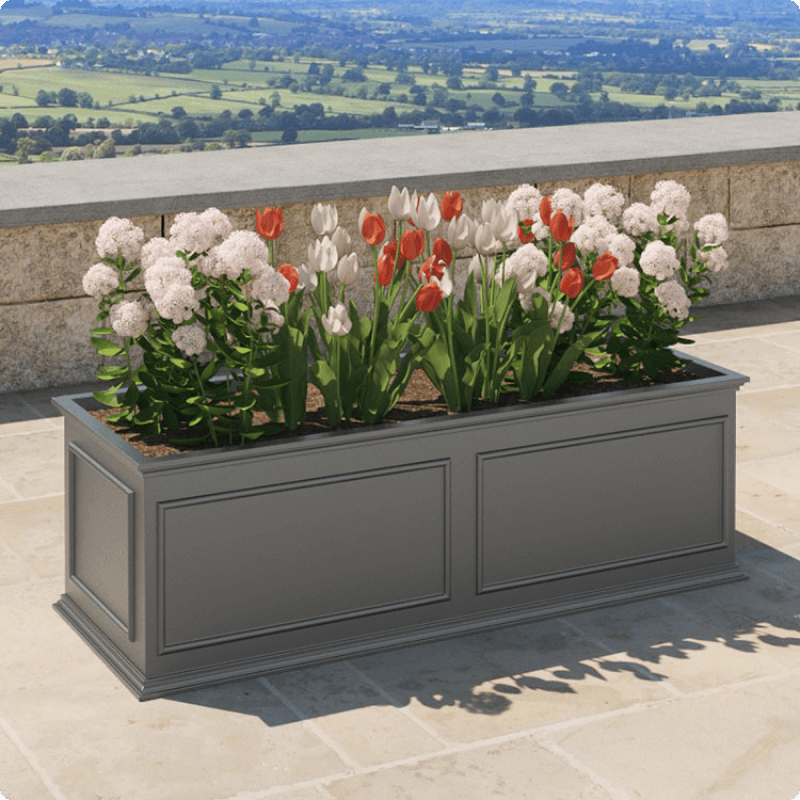

Charles and Ivy have made it their mission to create a stylish, durable, low-maintenance modular fencing system that enables people to transform and personalize their gardens. As their range of superior products took the market by storm, their offer has evolved to products that elevate interior spaces as well.

The company wanted to offer retail finance so customers could access their full range of products in an affordable way.

Having never offered credit in the past, Charles and Ivy began their search for a provider, when they encountered some concerns.

Credit limits

The company’s initial offering was up to £6,000. However, customers were eager to purchase their higher-ticket items, which exceeded this amount, while spreading the cost.

Approval rates

Charles and Ivy wanted a provider who would safely approve as many customers as possible for finance, which could be complicated with such high order values.

Conversion rates

To make offering finance profitable, Charles and Ivy needed a provider who could convert customers successfully from browsers to buyers.

DivideBuy acted quickly to meet the needs of customers based on feedback, offering Charles and Ivy a seamless finance solution which yielded strong results, including:

High approval rates:

DivideBuy’s tech-based lending engine, along with its Eligibility Checker tool, delivered approval rates of 82% for Charles and Ivy’s customers

High conversion rates:

Thanks to a sub two-minute credit journey, from application to approval, 86% of customers approved for finance with DivideBuy went on to complete a credit purchase.

Higher credit limits:

DivideBuy was able to increase its spending limit for £6,000 to £12,000, meaning customers could access Charles and Ivy’s full product range on finance.

Book your free 20 minute online demo

Tell us about you

How much does it cost to offer retail finance?

Letting customers spread the cost at checkout helps you boost sales – so it’s well worth investing in. Here are some potential costs to keep in mind.

When will interest rates come down – and what does this mean for merchants?

Will interest rates come down soon – and what will this mean for retail trends in 2024? Let’s take a closer look at this year’s predictions for merchants.

ePay Summit 2024 – We’re an Official Silver Sponsor!

We’re pleased to announce that we are this year’s ePay Summit’s Official Silver Sponsor, and Ceri Griffiths, our Head of Enterprise Sales, is joining the 2024 ePay Europe Thought Leaders cohort!

Do I need an FCA license to offer retail finance to customers?

Want to offer regulated retail finance to your customers? You’ll need FCA approval – but that doesn’t have to be a daunting process. Read this guide for your options.