Real-Time Merchant Portal

As a trusted Lendtech partner, we put you in the driver’s seat with our Merchant Portal. Get live insights for growth, with custom dashboards and in-depth reporting to help take your business further, faster.

Real-Time Merchant Portal

As a trusted Lendtech partner, we put you in the driver’s seat with our Merchant Portal. Get live insights for growth, with custom dashboards and in-depth reporting to help take your business further, faster.

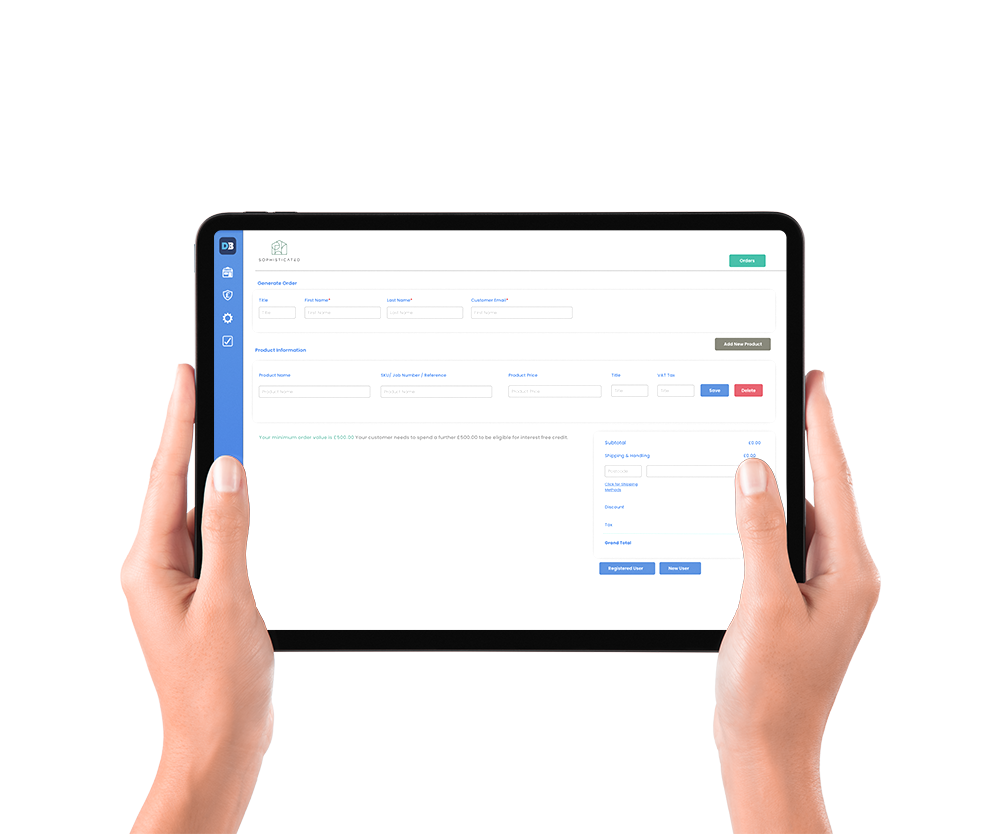

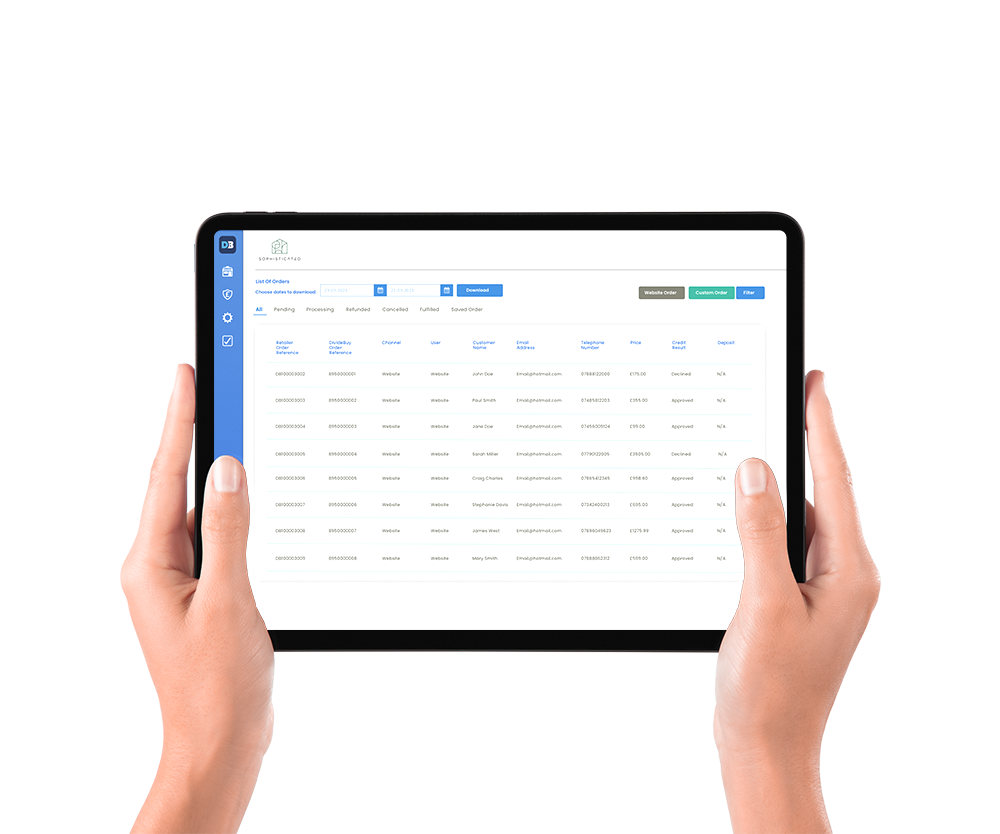

Order Management

With our Merchant Portal, you can see all your credit orders in one place, along with customer details, date and time and order status. Mark orders as fulfilled, track your order values and more.

View credit order values

Track and update order status

See customer order details

Our integrated tool will run through your platform continuously, checking order statuses and automatically dispensing payment on delivery.

InStore Solution

Our Merchant Portal can also be used inStore to support your brick and mortar business. Give customers the option to use credit right on the spot and turn more browsers into buyers.

End-to-end order completion

Instant eligibility check

Training for your sales team

For inStore orders, simply upload receipt of delivery to your Merchant Portal, and we’ll process your payment within 7 days.

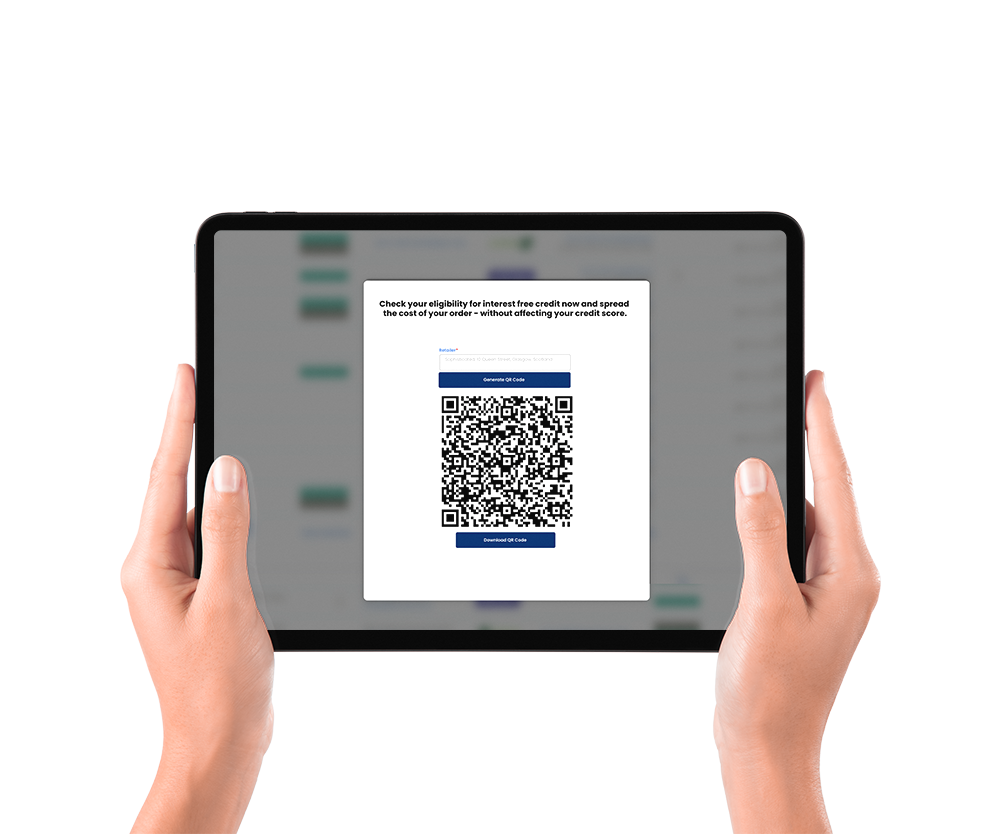

Eligibility Checker & QR Code Generator

DivideBuy’s Eligibility Checker gives customers the option to check if they’re eligible for finance before applying – without harming their credit score.

Rapid check, inStore and online

QR code generator for customers

Name, email and order value only required

Your Merchant Portal allows you to generate a QR code for customers to check their own eligibility on the shop floor – ensuring privacy and integrity for all parties.

Reporting & Analytics

Your account manager will customise your reporting dashboards for the insights that best inform your business strategy. Our Merchant Portal analytics will show you

Applications and approvals

Approval and deposit breakdown

Age and gender demographics

..and more. You’ll get a holistic overview of your credit customers, which your dedicated account manager will help you use to grow your business.

Book a Demo

Our credit engine is so seamless, we can demo it for you in less than 15 minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

More about DivideBuy

Find out more about our modular finance options and how we tailor them to suit your business needs.

From our status as an ethical lender to our award-winning tech, here’s how we’re delivering next-level consumer finance.

We partner with a wide range of UK merchants, from retailers to service providers – and the results speak for themselves.