About Retail Finance

30% of UK buyers are using consumer credit to spread the cost of purchases – so there’s never been a better time to make retail finance work for your business.

Flexible Finance Solutions

Our retail finance products are award-winning. Find out what we offer, including additional features, payment length options, the customer journey and more.

Interest Free Credit

(Unregulated)

Zopa’s 0% finance solution can be tailored to stretch from 3 to 12 months, depending on your customer and business needs.

Term Options

3 – 12 months

Interest Free Credit

(Regulated)

Zopa’s regulated 0% finance solution can be tailored to stretch from 12 to 60 months, depending on your business requirements.

Term Options

12 - 60 months

Interest Bearing Credit

(Regulated)

Zopa’s interest bearing finance solution can be tailored to stretch from 18 to 60 months, depending on your needs and product margins.

Term Options

18 - 60 months

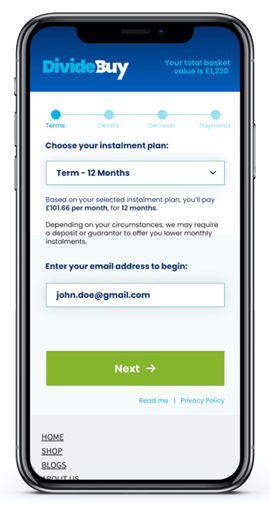

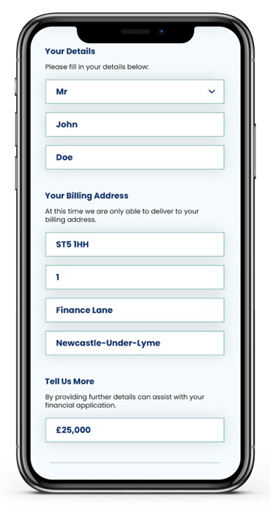

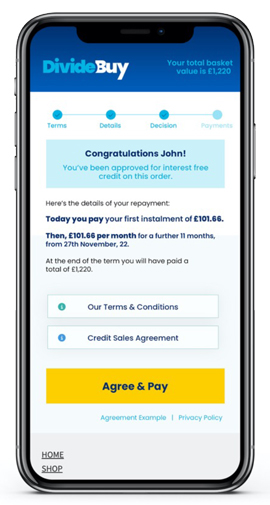

How your customer journey works

Our award-winning UX is frictionless and can be completed in less than two minutes. Our checkout integrates seamlessly with all major eCommerce platforms such as Magento, Shopify, Shopify Plus and WooCommerce.

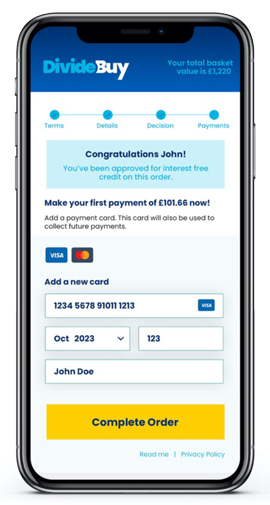

Step 1-

Select Terms

Step 2-

Enter Details

Step 3-

Instant Decision

Step 4-

Payment Details

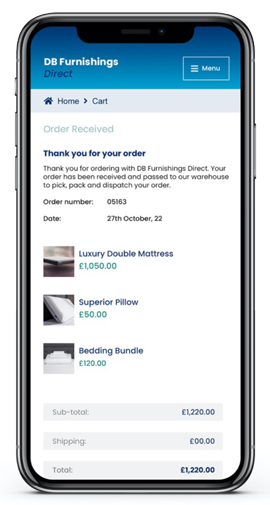

Step 5-

Order Confirmation

Keys to conversion success

Eligibility Checker

24% of shoppers say they’re more likely to apply to finance if told they are eligible upfront. Zopa's retail finance solution, DivideBuy, has a unique Eligibility Checker which lets your customers see if they are eligible for the amount they want to borrow – without harming their credit score.

Convert+

Customers can use our Convert+ widget to see a breakdown of the cost of their basket, spread over various payment terms. Set minimum spend thresholds for longer payment terms, giving customers the opportunity to increase order value, while benefiting from more time to pay.

How we pay you – in three simple steps

Once your customer order is fulfilled, Zopa will pay you the full purchase price, less our pre-agreed rate, and handle collecting payments from the customers ourselves.

1

Order Placed via DivideBuy

Customers can choose ‘Pay with DivideBuy at checkout’ and will be walked through our purchasing process – just like any other payment platform. The order will register with you as normal.

2

Proof of Delivery

of Goods

Once your customer has received their order, we’ll await documented confirmation of delivery from you, the merchant. This is done automatically via your Merchant Portal.

3

You're Paid

Within 7 Days

Upon receipt of delivery confirmation, we’ll pay you the full order amount, less or pre-agreed fee, in no more than 7 working days. We’ll then handle collecting from the customer.

Book a Demo

Our credit engine is so seamless, we can demo it for you in less than 15 minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Please note, a minimum turnover of £2.5M and minimum trading of 24 months is required to work with DivideBuy.

More about our retail finance solutions

Our Merchant Success team are more than just account managers – they’re an extension of your business.

From our status as an ethical lender to our award-winning tech, here’s how we’re delivering next-level consumer finance.

We partner with a wide range of UK merchants, from retailers to service providers – and the results speak for themselves.