Helping your healthcare business to drive sales

We help healthcare and wellness providers all over the UK to offer interest free credit from 2-12 months to customers, both online and in-store.

Book a demo

Enter your details below and a member of our team will be in touch.

Looking for technical help? Contact Support

Please note, DivideBuy may use the information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For further information on our privacy practices and commitments, please review our Privacy Notice.

Experienced in Healthcare

We work with many businesses in the healthcare and wellness sectors, including aesthetics, cosmetics and beauty, eyecare, mobility and supported living and veterinary practices. Our agile interest free credit for healthcare customers lets you spread the cost over 2-12 months, with a soft eligibility check and instant lending decision to help you turn more browsers into buyers – no matter where they’re shopping.

When using DivideBuy to offer interest free credit on healthcare and wellness to customers, our providers experience:

- A demonstration of our Online Sales Checkout, Merchant Portal, & application process

- Opportunity to address any questions you may have

- The chance for us to get to know your business better and determine the best solution for you

Want to know how to offer healthcare on finance to customers? Why not book a demo to see how we can boost your growth?

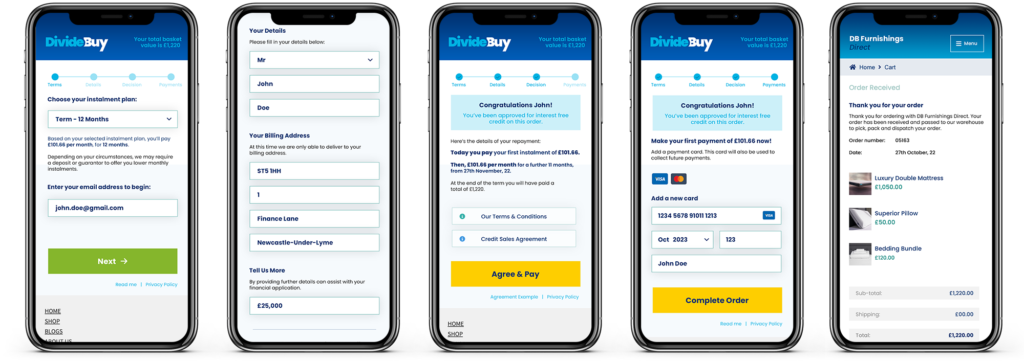

Seamless customer journey, completed in less than 60 seconds

What exactly can you expect from a Demo with DivideBuy?

- A demonstration of our Online Sales Checkout, Merchant Portal, & application process

- Opportunity to address any questions you may have

- The chance for us to get to know your business better and determine the best solution for you

“Very helpful. Glad that there is someone out there that can help me pay over time for my beloved pets.”

- K. Callery, DivideBuy Customer

What we can offer you…

Wondering about whether to offer interest free credit to your customers? We offer a variety of repayment plans to suit their budget. From 2 to 12 months – it’s flexible and always interest free.

Dedicated Customer Support

Our in-house customer care advisors will handle any client queries, whilst you focus on growing your business.

Sell-Anywhere Solutions

Our solution can be used online or in-store. Customer monthly payments are fixed at the same amount for the term of their agreement.

Rapid Application

With a 60 second application and an instant decision, your shoppers spend as little time as possible in the payment process, reducing the likelihood they’ll drop off.

15%

Increase in AOV for Retailer Base

Knowing they don’t have to pay all in one go gives customers the freedom to add extra items to their basket that may have normally been out of their budget.

Nearly 2,000

UK Retailers to date

With more consumers than ever looking to spread the cost on purchases, now’s the perfect time to stay competitive and offer finance to your shoppers.

70%

Average increase in Finance Conversions

Given more choice, customers that would normally drop-off your flow are more likely to convert to sales.

Like what you see?

You’ll be in great company…

Articles & Insights

All the latest news and updates about DivideBuy in the Furniture Sector

- DivideBuy Insights

- DivideBuy Insights, Industry Topics

- News

- DivideBuy Insights

- Industry Topics, Technology

- DivideBuy Insights, Industry Topics

- DivideBuy Insights