Pro Espresso, formerly known as The Barista Club, was founded by Tim Hammond, a successful entrepreneur and investor who is “eCommerce through and through” after working in the industry for over 24 years.

With a number of ventures under his belt, including building one of the first ever affiliate shopping platforms, Tim began investing in various FinTech and PropTech start-ups. In doing so, he became interested in the subscription model for high ticket items, seeing huge potential for this growing market. He also recognised the difficulty consumers had in getting barista quality coffee at home. And, as simple as that, the concept for the Barista Club and its monthly subscription coffee beans was formed. Customers loved the choice of 15 roasted coffee beans, and the online “blendometer” designed to help them find the bean to suit their tastes. But they soon began asking for advice on which coffee maker would pair best with their Arabicas and Robustas. So, Tim partnered with Sage’s award-winning kitchen appliances to begin offering high quality coffee machines too.

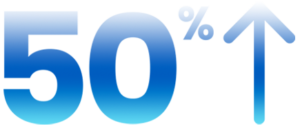

Since implementing DivideBuy’s interest free credit solution, Pro Espresso has experienced a phenomenal 50% increase in sales. As well as this, the customer feedback has been overwhelmingly positive, resulting in several raving Trustpilot reviews giving the partnership the thumbs up.

Commenting further, Tim said: “As a retailer, DivideBuy’s solution gives you a superb unique selling point, which makes a massive difference to customers. When it comes to high ticket items, implementing DivideBuy is an enabler for a huge increase in customer conversions.”

Equipped with a strong product range, Tim next needed to make sure Pro Espresso both stood out from other retailers, as well as supporting its customers with a valuable offering. He considered how he could offer his coffee machines in a similar style as his beans, since high-end machines come with a large price tag.

Inspired by this subscription model, Tim sought a partner which could help his customers easily spread the cost of a machine over 12 months, and one that still secured him the full payment upfront.

Since giving customers the opportunity to split up payments into instalments is about making the total cost more manageable, Tim also wanted a provider who wouldn’t add any interest on top of a customer’s purchase. That’s when he found DivideBuy.

Tim said: “I discovered DivideBuy through a LinkedIn contact, and the first thing that came to my attention when considering its solution was that there were no hidden catches. The technology is really easy to use, and best of all, the customer doesn’t have to pay any interest on top of the purchase price. This sets it way apart from the competition.”

After checking out the benefits of its solution, The Barista Club went on to partner with DivideBuy in June 2020 before rebranding as Pro Espresso.

Book your free 20 minute online demo

Tell us about you

When will interest rates come down – and what does this mean for merchants?

Will interest rates come down soon – and what will this mean for retail trends in 2024? Let’s take a closer look at this year’s predictions for merchants.

ePay Summit 2024 – We’re an Official Silver Sponsor!

We’re pleased to announce that we are this year’s ePay Summit’s Official Silver Sponsor, and Ceri Griffiths, our Head of Enterprise Sales, is joining the 2024 ePay Europe Thought Leaders cohort!

Do I need an FCA license to offer retail finance to customers?

Want to offer regulated retail finance to your customers? You’ll need FCA approval – but that doesn’t have to be a daunting process. Read this guide for your options.

Invest in Women: Accelerate Progress

As we celebrate International Women’s Day, it’s a moment to reflect on the progress made towards gender equality while recognizing the continued need for action. This year’s theme, “Invest in Women/Accelerate Progress,” calls for concerted efforts to empower and support women across all spheres of life. In this blog, we invited some of […]