This year’s Golden Quarter is one like no other: it’s the first “normal” peak shopping season for retailers following the various lockdowns of the Covid pandemic. Christmas 2020 was all but cancelled, so people are expected to go big with their festivities this year, which is leading to strong indications that the bounce back will be bigger than ever for UK retailers.

Research carried out by GfK shows that consumer confidence has been rising consistently through 2021 and even though it has dipped slightly during September due to cost-of-living anxiety, the figure is still well above the levels compared to the same time last year.

Let’s take a look at some of the trends we’re expecting to see this Golden Quarter…

Shoppers are ready to spend

UK consumers saved nearly £200bn during lockdown, with the majority of them planning to splash the cash on Black Friday purchases and Christmas gifts according to research from Future plc. One in four are expecting their Christmas and Black Friday budgets to increase this year, with over 70% having the same amount or more money to spend on Black Friday compared to 2020. The figure is even higher at 78% for Christmas.

The study also found that over half of consumers (55%) say they will make this Christmas the biggest celebration yet.

One of the main reasons for spending that money this year is the fact that lots of people feel as if they missed out in many ways last year. Whether it’s seeing more of loved ones, hosting festive parties, going on a family holiday or indulging in Christmas shopping experiences.

The research highlighted that looking for gifts digitally will be the number one ‘lockdown learning’ used by consumers this Christmas, so it’s essential for eCommerce retailers to ensure they’re prepared and have marketing campaigns ready to stand out from the competition.

Christmas has come early

So, when will the spending begin? It’s already begun!

A report from eBay Ads UK said a quarter of Brits planned to start thinking about Christmas shopping before the end of August, and 41% of consumers are aiming to get their Christmas shopping done before December even begins.

Last year also saw a much longer promotional season compared to previous years. Due to the strain on the supply chain, consumers were urged to shop early, with Amazon launching its Prime Day in October, a month earlier than Black Friday in November.

This year, the eCommerce giant has been rolling out “Black Friday-worthy deals” from the start of October in the US, so it’s fair to expect this to launch in the UK soon.

Not wanting to miss a slice of the action, it’s likely many retailers will follow suit and pull forward their Black Friday and Cyber Monday (BFCM) discount marketing campaigns or set up some smaller campaigns in reaction to entice customers.

Sometimes, despite the best intentions, consumers don’t always stick to their plans when it comes to getting organised, so it’s likely that this year’s Golden Quarter will be busy right up until Christmas. For last-minute shoppers, the increased adoption of Click & Collect means in-store deliveries and ‘Locker drop-offs’ will make eCommerce purchases possible beyond postage cut-off dates. Retailers who implement this as part of their available shopping options should see sales continue to increase in the final days leading up to Christmas.

Consumers are ready to spend so it’s important for retailers to remain front of mind with their target audience through effective marketing, and reminding them why they should spend their money with them and not a competitor.

Online first, brick-and-mortar second

We all remember the crazy social media footage of consumers queueing up outside stores in the early hours of Black Friday – or even camping out days before to get a spot at the front of the line. Yet, given the surge in online shopping compared to previous years and people still wanting to remain relatively social distanced from strangers, it seems the days of people fighting over TV’s may well be a thing of the past.

The survey by eBay UK found that 57% of consumers expect to do most, if not all, of their Christmas shopping online, of which 16% plan to do all of their shopping online. This online-only approach to festive shopping has increased since 2020 too, with just 10% saying they were planning to do all of their shopping online last year.

Shoppers are also heading online to research gifts beforehand, and this applies whether they plan to buy online or in-store. With 63% of people saying they’ll do online research before committing to a purchase, this may mean eCommerce retailers experience higher rates of cart abandonment at this time of year, so looking at ways to reduce this should help turn those browsers into buyers.

Welcoming family and friends

While 2020 saw many of us spending money on home and garden improvements, the prospect of welcoming family and friends into our homes for festive get-togethers means the home furniture and flooring categories are still seeing increased spending.

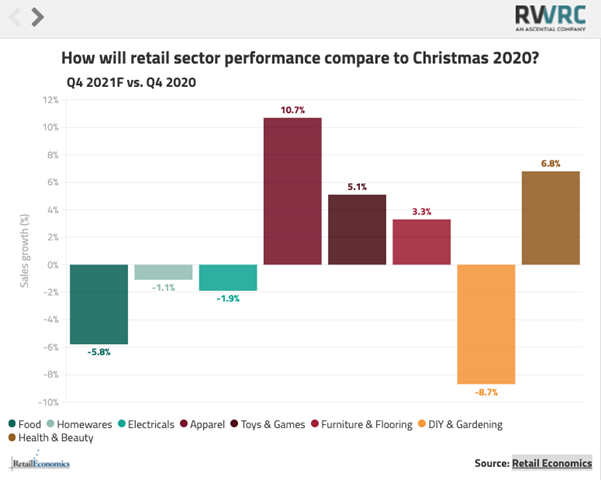

Retail Economics have predicted a 3.3% increase in the ‘furniture and flooring’ sector in Q4 2021 compared to last year. Similarly, eBay Ads UK’s study saw their home, furniture and DIY categories jump 85% in the months leading up to Christmas 2020 and the predictions are for the same this year.

As we go through the Golden Quarter, consumers have plenty of choice as to where to spend all the money they’ve saved during lockdown. All eCommerce retailers will have to work hard to make sure they stand out from the crowd. Convenience for shoppers and targeted marketing is key to ensure they know who you are and why they should choose your products.

Savvy shoppers like to spread the cost of their festive purchases, so providing your customers with easy ways to pay and an interest free credit option will help you increase your sales and set you apart from the competition.

Tweet

Tweet

Facebook

Facebook