Interest free and interest bearing credit vs buy now pay later solutions

People are often unsure about which shopping cart solution is better for consumers and retailers. One of the main areas of discussion is the difference between interest free credit and interest bearing credit vs buy now pay later solutions.

There is no single answer to which is better. Ultimately, what works best for you will depend on the level of affordability if you are approved, your understanding of how the credit is structured, and the level of transparency among lenders.

Some buy now pay later providers are not always transparent about what’s required from the customer and what fees may be added if they miss a payment, which can cause confusion.

On the merchant side, some pay later providers leave it up to the retailer to ensure they maintain reasonable standards of modelling and underwriting regarding buy now pay later finance, including the level of APR they charge.

What is buy now pay later?

Buy now pay later is a shopping cart plugin payment option that enables customers to delay paying for a product or service for an agreed period of time – hence the name ‘buy now, pay later’.

Unfortunately, there are currently no consistent standards or structure around buy now pay later credit, which means many providers pick and choose when to add fees. The broad principle is, if you clear the balance you owe before the 0% period comes to an end, you should not incur any additional cost of credit. However, if you do not pay off the balance before the 0% interest ends, an interest fee is added.

For Shoppers | How it works

Using Zopa’s retail finance solution, DivideBuy, to pay in interest free or interest bearing instalments is straightforward, fast and totally transparent. Also known as ‘shop now, pay later’, our buy now, pay later service allows you to spread the cost for up to 60 months, depending on what borrowing option you choose and what the merchant is offering. The simple application takes you straight to your credit decision. Unlike many pay later providers, there are no extra ‘hidden’ costs applied to your account and any interest we charge is clearly stated in the terms of your borrowing agreement if you’ve chosen an interest bearing option. If you’ve chosen 0% finance, you won’t be charged any interest.

Step 1

Choose a retailer from our directory, place the items you’d like into the shopping basket and select DivideBuy at the checkout as your payment method. Our application process is quick and should take you less than a minute to complete.

Step 2

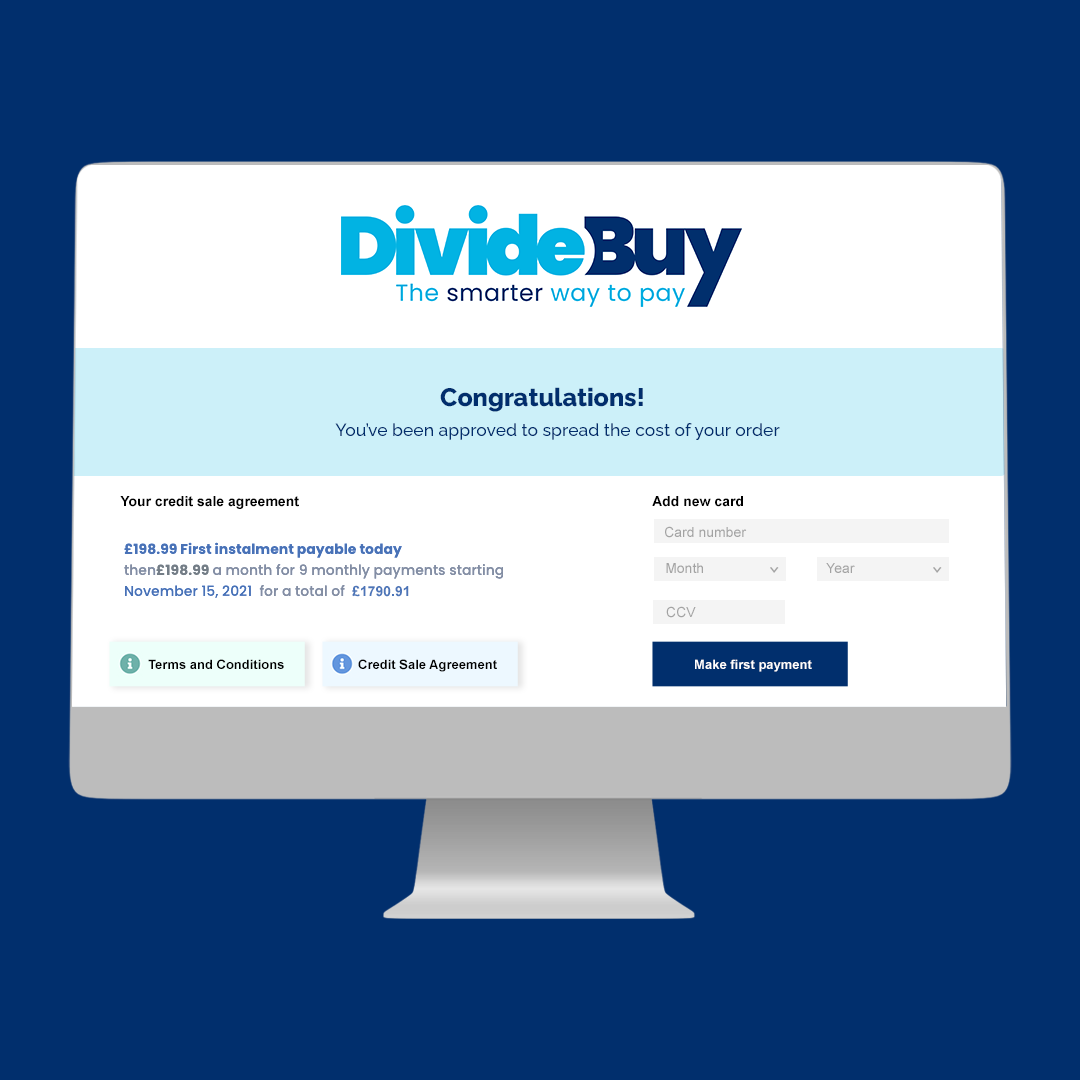

Complete the form and we’ll give you an immediate decision. If approved, you’ll need to pay an initial instalment, followed by an electronic signature. The retailer will then notify you of delivery times.

Step 3

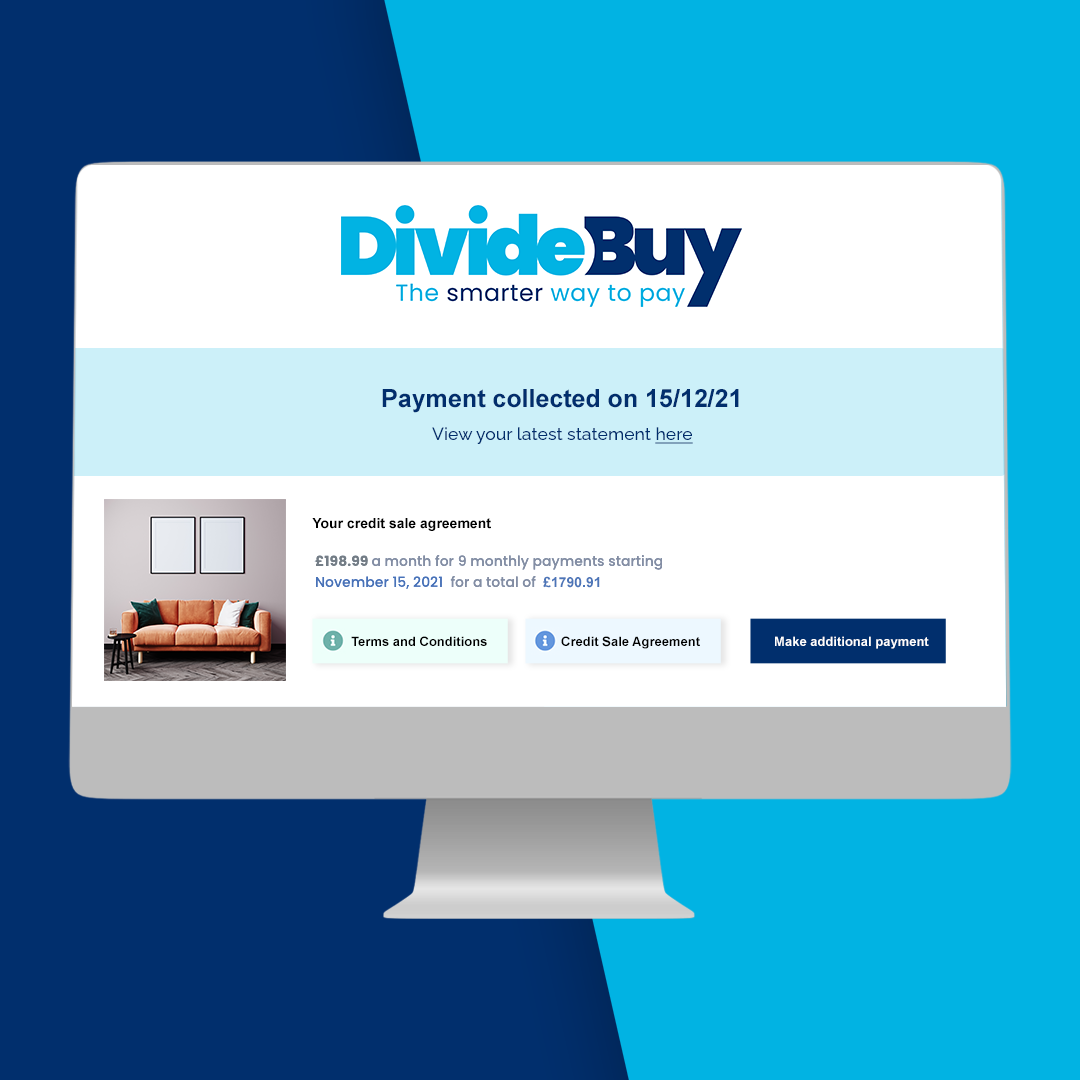

Your payments are collected monthly until your balance is paid. Plus, you can manage your account online and make additional payments, so you are in control at every stage.

Start shopping with DivideBuy

We work with hundreds of retail partners giving you choice over where you shop. You can choose the term length based on your basket and also choose the date your payments are taken. Our commitment to total transparency means there are no hidden fees or charges, and our terms and conditions are crystal clear.

Take a look at some of our retailers below.

Search all shops

Browse shops by category

For Retailers | How it works

Zopa’s retail finance solution, DivideBuy, ensures that your retail finance process is clear to understand from the very beginning and we do not hide any payment figures from customers. When a purchase is made, the customer pays a first instalment and chooses to spread the remaining cost over a number of monthly payments. There are no hidden fees, and interest is only applied if the customer has taken out an interest bearing payment option.

The choice of interest free and interest bearing credit also depends on the level of affordability for customers who are approved. With our unique credit decision engine, we outline multiple factors for lending, looking at what the customer can pay today rather than what they have been paying or will be paying. This significantly reduces the risk of a customer finding themselves unable to pay later.

More approvals, more business, less risk

Our robust, holistic approach and unique credit decision engine enables us to accept more customers than other pay later solutions.

Not only that, but in comparison to many buy now pay later providers who only take a snapshot of a customer’s financial risk, our interest free and interest bearing credit platform helps to build up the customer’s credit score. This means they are more likely to be able to return in the future and purchase more from our retailer partners.

Our interest free and interest bearing credit solutions help to build up the customer’s credit score

The downside of buy now pay later providers

Possibly because of a lack of clear, consistent standards between different buy now pay later providers, many people in the UK do not fully understand shopping cart pay later solutions, particularly younger people.

A study by Arrow Global, for example, compared the understanding of APR among all UK adults against those between the ages of 18 to 24. The results showed that nearly a third of young people do not know what the term APR means.

One potential downside of buy now pay later from the consumer’s side is that if they do not complete their purchase in full by the pay later date, they will need to make the minimum monthly repayment required, including interest. Any missed payments may also result in a penalty charge from the credit provider.

How does buy now pay later work for businesses?

Buy now pay later (BNPL) solutions work for retailers by allowing customers to purchase products without paying the full amount upfront. Retailers partner with BNPL providers like Zopa to offer customers the option of spreading the cost of their purchase over several instalments with our retail finance solution, DivideBuy. The retailer receives the full payment from the BNPL provider, while the customer pays the provider back in instalments over a set period. This arrangement can be beneficial for retailers as it can increase sales, reduce cart abandonment, and improve customer loyalty.

Why your business should offer a buy now pay later option?

Choosing a buy now pay later solution for your business can be beneficial in several ways. Firstly, it can help increase sales by making products more affordable and accessible to a wider range of customers. Secondly, BNPL solutions can reduce cart abandonment rates by allowing customers to spread the cost of their purchase over time. Thirdly, it can improve customer loyalty by providing a convenient and flexible payment option. Finally, partnering with a BNPL provider like Zopa and our retail finance solution, DivideBuy, can also help businesses to manage their cash flow more effectively by receiving full payment upfront while customers pay in instalments.

Why Zopa

Providing customers with our buy now pay later interest free and interest bearing payment options can help to increase sales and average basket values, while reducing basket abandonment. We offer longer terms than our interest free and interest bearing competitors, running from 3 to 60 months, and we give retailers flexibility when it comes to the products and amounts they want to offer. Our retail finance solution, DivideBuy can be integrated quickly and is easy to use.